Financial Planning and Analysis: First step towards better tomorrow

Financial Planning as tough as it may sound to achieve in the modern world, it is the most important and the first step towards having financial freedom in your life.

But let us first try to understand “What is Financial Planning and Analysis”?

Financial Planning and analysis can be defined as the process which provides you a framework for achieving your life goals in a systematic and planned way.

In other words, it is the process of developing a personal roadmap for your financial well-being. The inputs required for your financial planning and analysis process are:

Your Finances

- Income

- Assets

- Liabilities

Your Goals

- Current and Future financial needs

Your appetite for risk

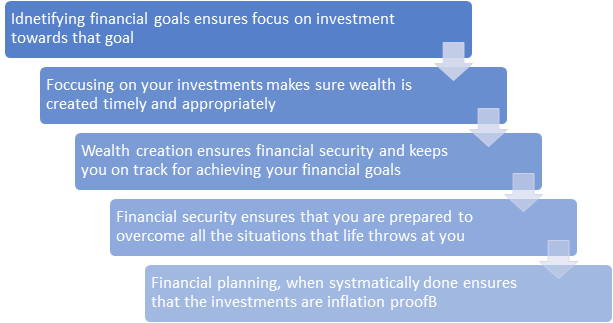

In short, financial planning is the process of systematically planning your finances towards achieving your short-term and long-term life goals.

Importance of Financial Planning and analysis

Many people think they can manage without financial planning but when they realize the importance of financial planning, often it’s too late as they don’t have the necessary inputs (resources) to achieve their financial goals.

Let’s take an example of today’s generation, most people want to live their life to the fullest and they realize the importance of doing so. Consequently, many opt for early retirement from full-time jobs, as compared to a few decades ago, when most people worked till 60 years and some percentage of people even after that. Life expectancy is increasing at a very good rate due to various innovations and advancements in the medical field.

The average person can, today, expect to live a healthy life well into his or her seventies or eighties, which means that retirement life is almost as long as working life. It implies that savings (after considering inflation) should be enough, not just to maintain the same lifestyle for almost 15-20 years, but also to take care of medical expenses, which are usually higher when the person gets older. That’s why it’s critical for everyone to start planning their finances from an early age.

Benefits of Financial Planning

- Inflation is the biggest destroyer of purchasing power. Fp&A ensures you sustain inflation while keeping your goals unaffected.

- It helps you achieve your long-term goals with a proper financial plan in a specific period. It is better to plan early since it may earn high returns over the period.

- Prevention is better than cure and when it is especially about money, getting ready is better than regretting.

- Providing financial security to your family is the most important part of financial planning.

- The most important of all, financial planning is a step toward your dreams. It supports your dreams while you are busy handling our other responsibilities.

- Financially secures retirement life. Financial planning helps you create an adequate corpus for retirement when expenses continue, and income dries up.

- Helps in monitoring cash flows.

- Reduces unnecessary expenditure.

- Reduces tax liability.

- Maximizes returns from investments.

- Creates wealth and ensures better wealth management to achieve life goals.

Financial planning process

Hopefully, I have been able to convince you that you need financial planning. So, when you decide to get into it, financial planning has the following steps:

1. Identify your current financial situation

Sit down with your spouse and other earning family members and record all information about your sources of income, debts, assets, liabilities, etc. This gives you a clear picture of your current financial situation.

2. Identify your goals

Record all the goals of each of the family members in terms of long- and short-term goals. Prioritize each goal by establishing consensus and put a time period against each of the goals. Quantify each goal. This enables how much money you need for each.

3. Identify financial gaps

From the above steps, you will be able to gauge where you stand financially, and where you want to be. You would now have exact figures of how much you have or can expect from regular sources of income and how much you need to fulfill various goals.

A simple calculation will give you an idea of the shortfall. This is required because identifying the right investments to cover the shortfall depends on you quantifying the income from your investments.

4. Prepare your personal financial plan

Review various investment options such as stocks, mutual funds, debt instruments fixed deposits, gilt and identify which instrument(s) or a combination best suits your needs. While preparing the plan, keep in mind that the time frame for your investment must align with the time period for your goals.

5. Implement your financial plan

Get Set Go! It’s time now to put things into action and start investing.

6. Periodically review your plan

A successful financial plan needs serious commitments and review at regular intervals. Financial planning is not a one-time activity. Make changes to your financial plan depending upon your current financial situation.

Individuals who feel financial planning is just beyond them should consult a financial advisor, who suggests and advice on various investment options. With a plethora of financial instruments available these days, it becomes difficult to finalize products that give short-term and long-term gains and are aligned with your financial goals. A financial advisor who has sound knowledge of finances and who can help you in maximizing your returns and make your money work hard for you comes to your rescue.

Financial advisors nowadays use various financial planning and analysis products to help them with productivity gain and quality engagement with their end customers.

We at Mirketa, are launching FINACAST which compliments Salesforce Financial Services Cloud by adding intelligent Financial Planning, PFM, and Cross-selling feature to it. It is designed to engage customers that empowers them to take control of their finances and provides planning and tracking tools for Wealth Managers.

Finacast creates a holistic snapshot of customers’ financial health with their existing understanding of their goals, financial status, and financial products that they have.

It then allows simulation of the creation of multiple scenarios of financial incidents/life events. The product then generates the impact of these scenarios on their overall financial health thereby providing an environment to have a realistic financial plan.

The key benefits of a financial institution could be

- True 360 view of the customer

- Target product offering based on simulations which increases the possibility of cross-selling.

- Highly engaged customer through self-planning portal

- Operational efficiencies by bringing CRM, Cross-selling and Planning tools together

Advance self-planning features can be built-in as optional bank fees

It was a very helpful tip when you said to jot down some of the biggest goals of the family in order for you to determine the most cost-effective way of spending your resources. My family came from a life of poverty, and we so are blessed because we had finally overcame it. We wouldn’t want that to happen again, so we’ll definitely look for professional services that can help us with financial planning.